EFRAG’s July 31, 2025 Omnibus Exposure Drafts mark the most significant overhaul of the European Sustainability Reporting Standards (ESRS) since their initial release under CSRD. However, the substance of requirements remains intact, and many disclosures are simply streamlined, reorganized, or moved to guidance rather than eliminated. Significant drivers remain, so the workload is not substantially reduced.

Key Changes and What They Mean for Financial Institutions

- Sharper Materiality Lens: A new top-down approach simplifies Double Materiality Assessments, reducing documentation for “obvious” cases while clarifying when an impact, risk, or opportunity triggers disclosure.

- More Flexible Reporting Design: The drafts allow executive summaries, appendices for technical details, and reliefs for complex metrics, introducing efficiency without compromising transparency.

- Environmental Standards Stay Complex: E1–E5 retain depth, adding metrics for critical raw materials, biodiversity-sensitive areas, and packaging waste. Climate transition plan disclosures remain mandatory but are streamlined.

- Consolidated Governance and Social Disclosures: By shifting key human rights, workforce, and governance requirements into ESRS 2, the drafts reduce duplication while sharpening focus on risk management, accountability, and consistent treatment of social policies.

- Transparency vs. Burden: While guidance like Non-Mandatory Illustrative Guidance (NMIG) and sectoral reliefs offer breathing room, expectations for credibility and rigor remain unchanged.

What is Next?

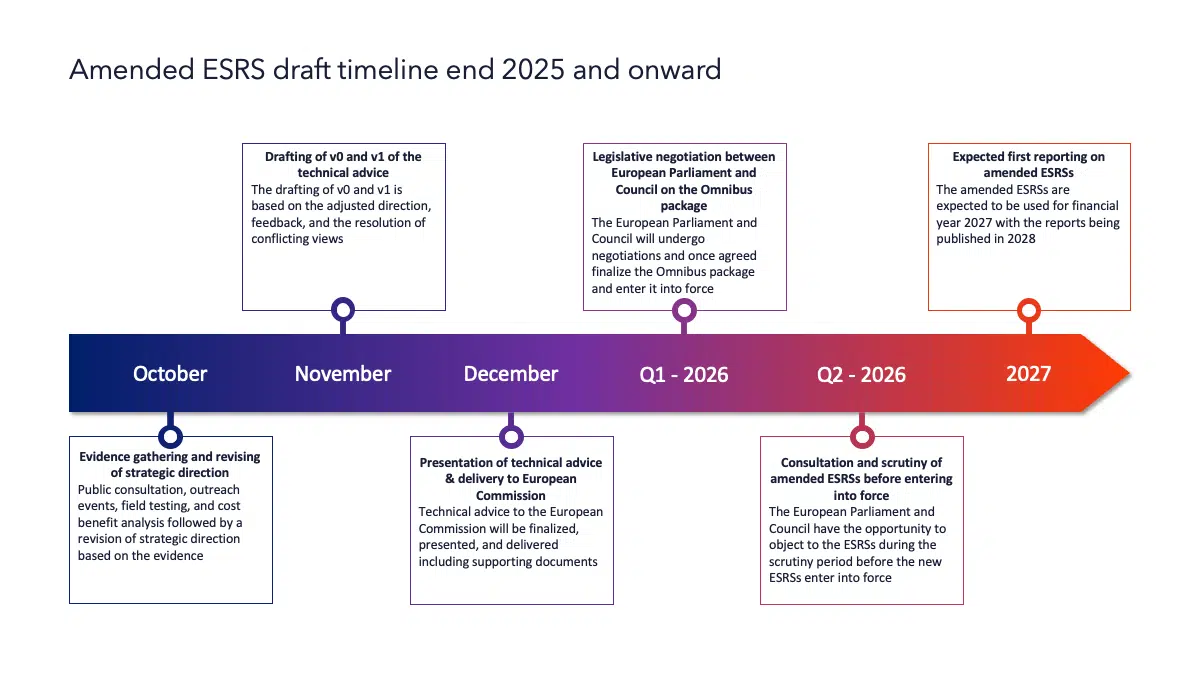

Public consultation closed on 29 September 2025. EFRAG’s final technical advice is scheduled to be presented by the end of November. Following this, the European Parliament and Council will negotiate and finalize the Omnibus package. Shortly thereafter, the European Commission is expected to adopt the amended ESRS through a delegated act. This delegated act will undergo a short consultation and a scrutiny period by the Parliament and Council, with the amended standards anticipated to apply starting from financial year 2027.

Our Perspective

For financial institutions, these changes are an opportunity to refine reporting architecture, integrate ESG with governance structures, and align with other sustainability standards, like IFRS S1/S2, to avoid reporting fatigue. Simplification doesn’t mean “less work”, it means smarter work.