Our Sustainable Finance Capability

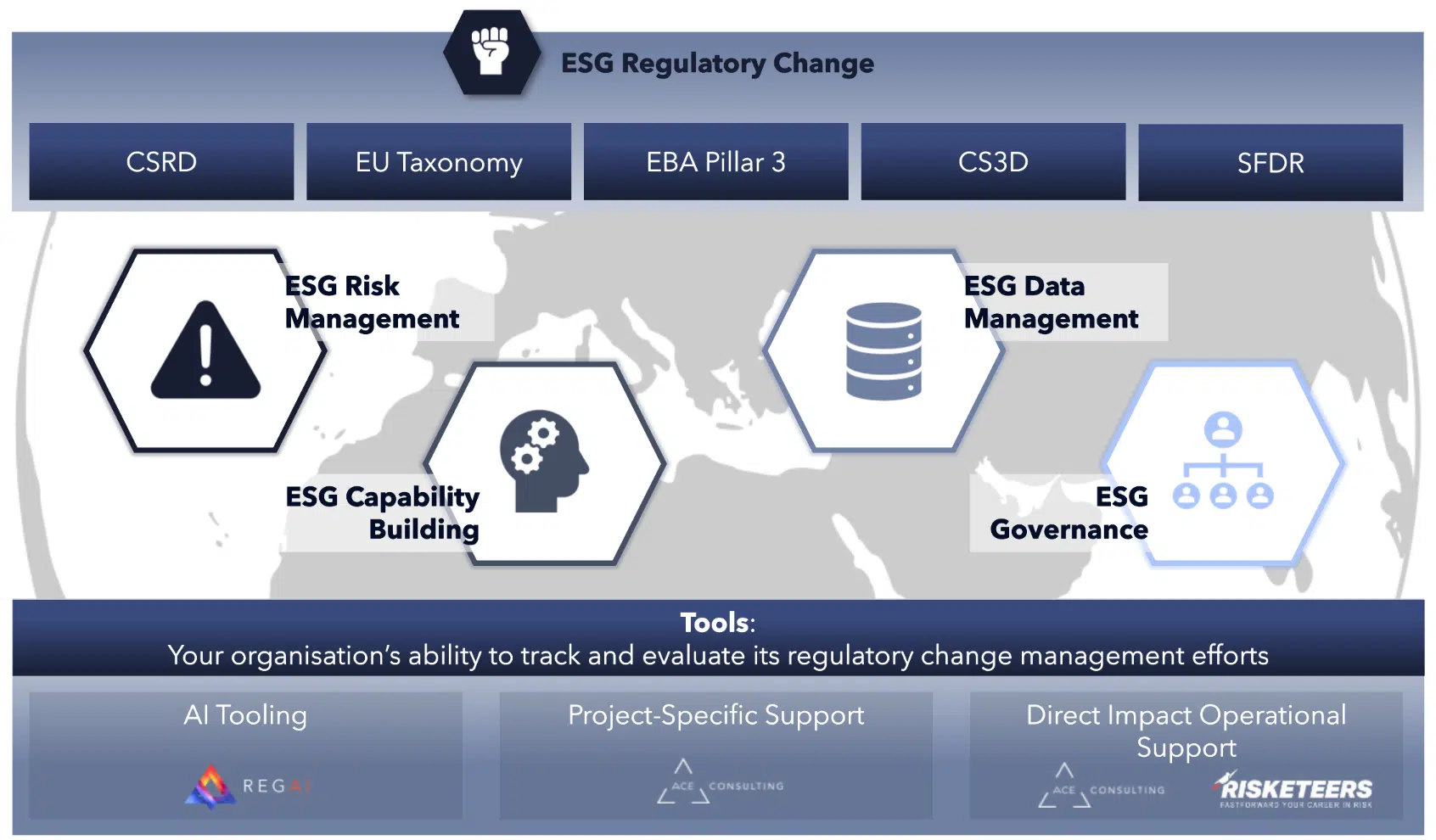

To support financial institutions in navigating the complex and fast-evolving sustainability landscape, we offer a comprehensive Sustainable Finance Capability. This offering is built around five key domains that help embed sustainability into core operations and strategy, enabling institutions to meet today’s regulatory expectations, while also enhancing long-term resilience and stakeholder trust.

At the heart of this capability lies regulatory change management, which functions as a cross-cutting enabler across all domains, driving transformation, setting priorities, and ensuring alignment with regulatory developments.

To activate these capabilities, we provide a tailored set of tools and services, including AI-powered solutions, project-specific expertise, and direct operational support. These enablers empower institutions to translate sustainability ambitions into tangible outcomes and stay ahead in a dynamic regulatory environment.