Streamline Data Management for Clarity and Confidence

Risk Management, Regulatory Reporting, Compliance, CSRD and many other functions require a complex set of processes and data within a limited timeframe and is an integral part of the wider banking ecosystem. Data Management should help stakeholders in organisations to overcome the full complexity of the entire ecosystem and be able to only be concerned with the part that they actually require. Often, data flows through the ecosystem, at least partially, using Excel sheets and e-mail, both of which are difficult to track and trace. This can cause governance issues, but certainly amplifies the lack of auditability. It is not only difficult to repeat the same process every reporting cycle, but also virtually impossible to reproduce the exact process that was used at a certain moment in the past.

A large portion of the complexity within data management lies not only with the data itself, but also with the processes, people and tools around it. Due to the sheer size of financial institutions, these organisations often experience difficulty in finding alignment. Not only is the possibility of repeated effort present, there is also a lot of manual effort involved, taking away valuable time from the organisation’s resources.

The most efficient way to streamline this process, is to build an auditable-repeatable process around who-does-what-when. Although this may sound like a straightforward and easy concept, this is actually lacking on most of the organisational processes. This concept will bring in confidence in reports that are generated, and it enables the executive suite to use the intelligence obtained from the reports for strategic decision-making. Furthermore, it provides stakeholders with transparent risk management information, and clear information for strategic management decisions.

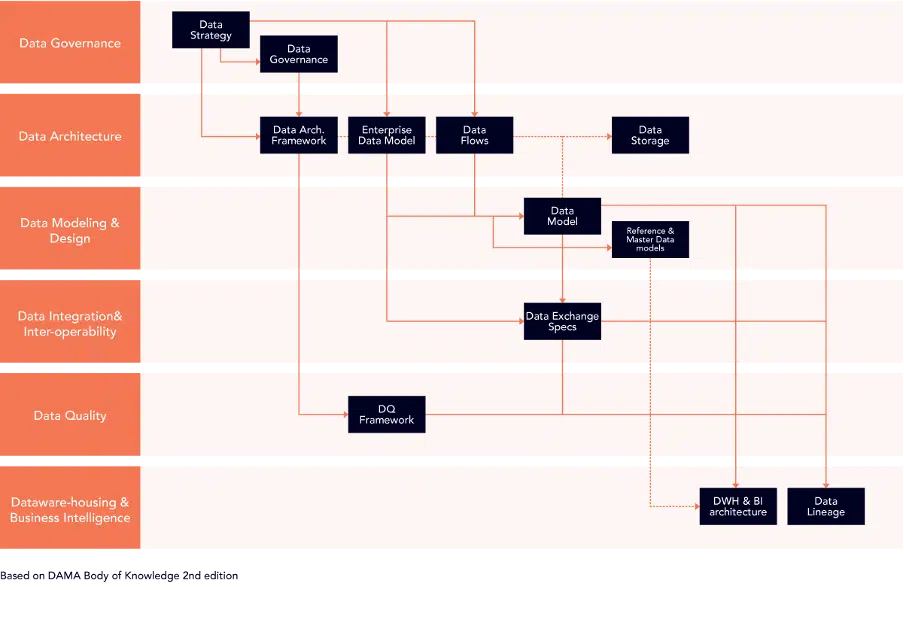

Based on the DAMA Book of Knowledge, ACE will help you to

- assess the maturity of your data management;

- identify the most critical areas;

- organize and plan structural improvements;

- mobilize and guide your teams through the changes.