Why the Regulatory Puzzle Needs a Fresh Approach

Between continuous ESG updates, AI Act developments, and the impending Basel III final reforms, financial institutions face a flood of new rules that can overwhelm even well-staffed compliance teams. Over the years, RegTech solutions have come a long way to support these processes, reducing manual effort with greater accuracy. To illustrate, horizon scanning tools help spot what’s coming and what’s important, GRC platforms assist in managing who’s responsible, and reporting solutions crunch disclosure data.

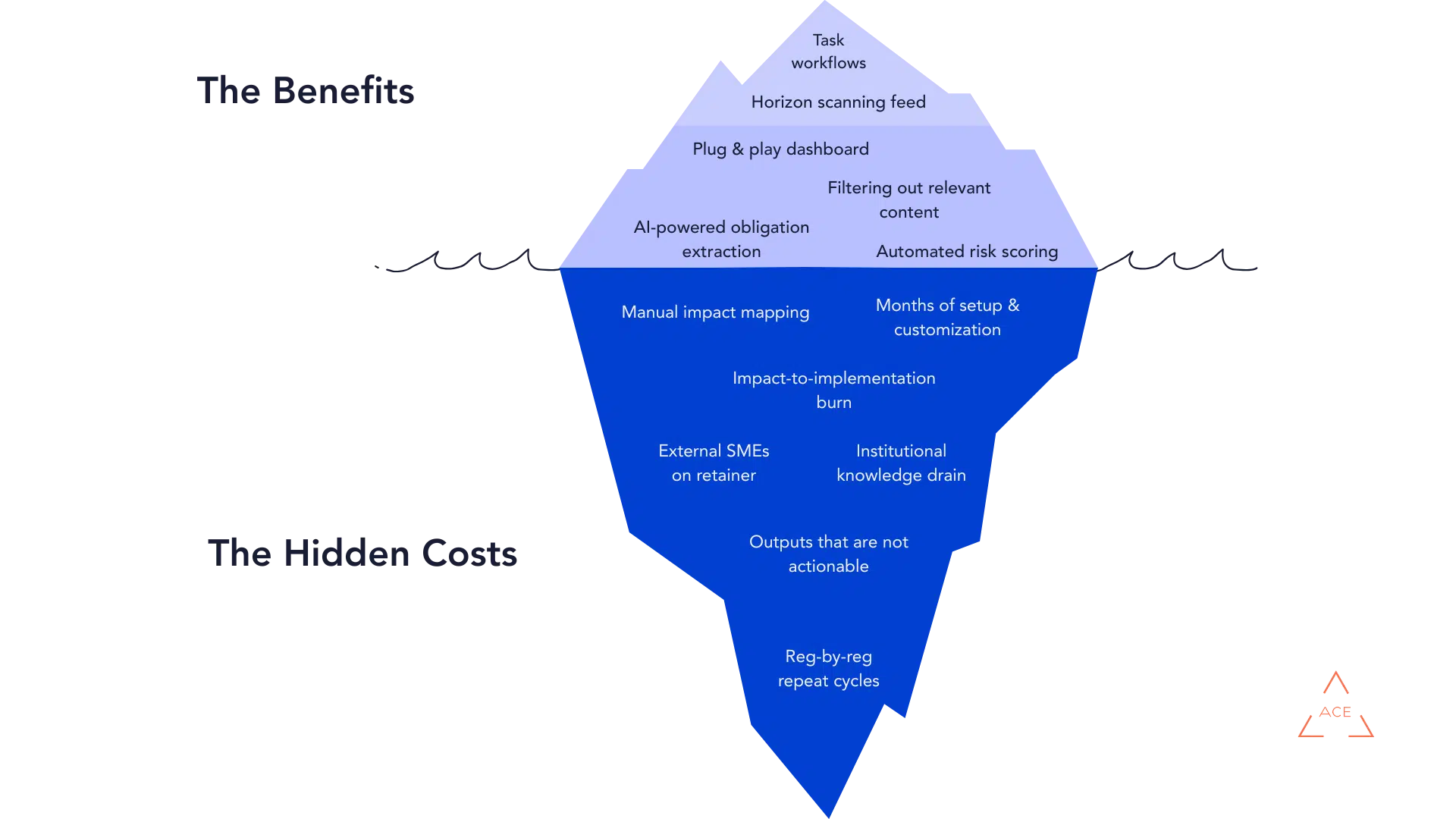

Yet an iceberg still lurks beneath that glossy surface. As the pace of regulatory change accelerates, many firms discover that ‘knowing what’s coming’ is only the tip. Below the waterline, hidden costs can weigh down the organization’s ability to stay agile and efficient. That’s where a fresh, truly integrated approach is needed.

The costs beneath the surface. While RegTech solutions highlight visible benefits, many hide a larger mass of manual work and operational risk.

Hidden Complexity and Manual Dependence

Our review of over 70 RegTech offerings revealed that roughly 3 out of 4 solutions focus primarily on the software’s technical capabilities, rather than how it integrates with a firm’s business processes. As a result, many of these tools require ongoing (and often external) subject matter expertise to interpret the downstream impact of new regulations.

Our recent RegTech landscape analysis confirms that while many solutions excel at scanning or baseline reporting, they still lean on heavy specialist involvement to interpret practical impacts. In other words, the technology might highlight new obligations or let you track them in a dashboard, but it rarely spells out the repercussions for your product lines, IT dependencies, or entire operating model.

Compliance analysts therefore end up bridging this gap themselves or bringing in outside consultants, a short-term fix that siphons institutional knowledge. Even a single RegTech implementation can stretch beyond a year, given the blueprinting, customization, and testing required to adapt a standard tool to a bank’s unique processes. Each time the regulatory landscape shifts, the cycle restarts and the iceberg of hidden effort re-emerges. We see it as a sign that the market needs solutions built around genuine financial-sector knowledge, so teams aren’t forced to reinvent the wheel every time a directive lands.

Infusing Domain Expertise from Day One

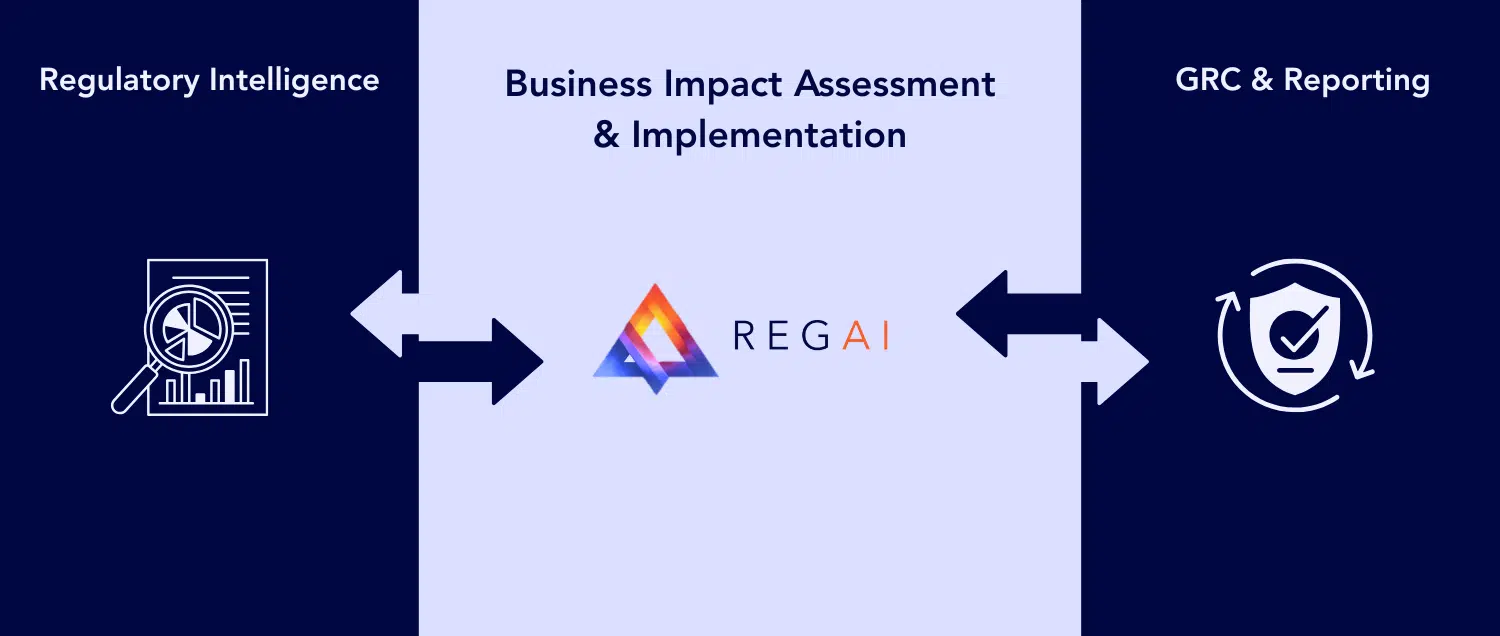

Through our own consulting activities and industry research, ACE recognized that a truly effective RegTech solution must come pre-loaded with practical banking know-how. While horizon scanning tools tell you what is coming, and GRC solutions manage who does what, the AI-enabled impact assessment helps to pin down how your business processes and cost structures will be impacted.

RegAI complements them at precisely the point where deeper business impact assessment is required. By uniting advanced AI with ACE’s decades of financial-sector consulting expertise, we enable new rules to be analyzed against your existing frameworks, providing actionable steps for your day-to-day operations.

- Connected Regulatory Intelligence. Designed by ACE’s own consulting experts, RegAI doesn’t just note obligations; it interprets them in a financial institution’s context. Think of it as the “missing link” between the raw data feeds from horizon scanning and your downstream GRC or reporting frameworks.

- Traceability to Reporting. RegAI links each regulatory requirement directly to the relevant policies, processes, and data points. Rather than leave you manually mapping DORA or ESG mandates into internal workflows, RegAI shortens the journey from ‘we need to do this’ to ‘here’s how we do it’.

- Flexible Delivery Model. Whether you want just the AI software to handle advanced business impact analysis or a more hands-on consulting partnership to reshape your entire compliance approach, we have you covered.

Practical Impact

Time after time, we’ve seen how the ‘plug-and-play’ promise turns into a months-long process. European financial institutions spend an estimated €90-120 billion annually on regulatory compliance, and the number of compliance officers has doubled in the past decade. Yet much of their work is still bogged down by repeated manual mapping: each new rule from a fragmented, ever-shifting regulatory landscape must be painstakingly interpreted, reconciled, and documented. By automating these repeated tasks, RegAI frees compliance teams from the endless cycle of re-checking, allowing them to focus on higher-value decisions.

From Regulation to Actionable Items

RegAI’s architecture is modular and designed to integrate seamlessly with the rest of your RegTech stack:

- Regulatory Nexus

Pull in upcoming changes (think DORA, CSRD, or any new EU directive) and get plain-language breakdowns.

- Organizational Lens

Map legal requirements against relevant frameworks (including your own). Pinpoint where these changes affect your internal policies, processes, and reporting.

- Policy Workbench

Quickly highlight conflicts, redundancies, or missing statements to keep all policies cohesive. Accelerate the creation of new statements and harmonize policies across hierarchical domains.

- Regulatory Data Lineage and Acceleration

Connect obligations all the way down to key data points, helping produce robust compliance documentation with minimal friction.

Bridging the gap. RegAI sits between reg-intelligence feeds and your GRC / reporting stack, translating “what’s coming” into business-ready actions, and feeding confirmations back the other way.

There Is a Better Way to Truly Simplify Compliance

At ACE, we believe the next step in RegTech is about weaving industry expertise into the technology. By embedding deep financial-sector knowledge at every level, your team can spend less time navigating partial solutions and more time making strategic, high-level decisions. Here’s how we do it:

- Better Operational Alignment

By tying each regulatory obligation to the relevant policies, processes, and data points, RegAI bridges the space between horizon scanning, GRC tasks, and reporting frameworks. Every new rule can be implemented with fewer manual steps and less guesswork.

- Reduced Complexity

Our built-in domain expertise simplifies compliance efforts across the board, so you won’t need to decipher raw data feeds or continually rewrite policy language on your own. RegAI tackles what’s under the waterline, so only true simplicity remains on the surface.

- Scalability

Because it complements existing tools rather than replacing them, RegAI naturally adapts to your bank’s expanding regulatory demands, from the AI Act to ESG reporting and beyond. The platform evolves alongside you, so new requirements don’t become full-blown projects every time.

Ready to See RegAI in Action?

Contact Nick or Mehul to see RegAI in action and learn how our combined platform and service model can ease the tension between technology potential and real-world constraints.